There is a very common debate on whether you should pay down your mortgage or not. There are people rooted in both camps with the exact opposite views.

Yes, you should pay down your mortgage.

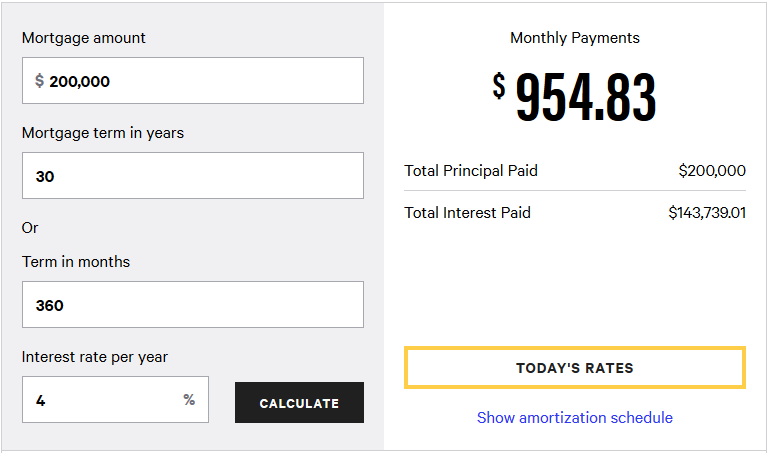

After all, you’re paying a lot of interest for the amount of money you’re borrowing. For example, for a $200K 30 years mortgage fixed at 4%, your total interest will be a whopping $143,739.01 provided that you do not pay any extra towards the principal throughout 30 years.

No, you should never pay extra towards the principal.

Taken the example earlier, you are paying only 4% of interest for $200K. Where can you find such a low interest for that much money? Nowhere! Instead of paying down your mortgage, you can invest the money via stock, mutual funds, real estate projects … the list can go on and on. And if your mortgage interest rate is low, i.e. 4%; it’s very likely you can make that return in a long horizon.

So now the question is … should you pay extra or not?

Like everything personal finance, it is a very personal matter. So the answer here is very simple: it depends.

For our household, we had a long discussion going back and forth on this topic.

In 2015 March, we got our mortgage in our current home at a fairly good rate. To make it easier to remember, let’s say it’s 4%.

Then, in 2015 December, we decided to start paying extra on the mortgage, and that would put us 5 years earlier in paying off the mortgage. We believed there were merits to both paying or not paying off early views, so we started paying a little more but not too much. That was our Goldilocks spot at that time.

But in Sept 2019, we made our final and firm decision to up the game and on the road to pay off our mortgage in less than 9 years.

This is not an easy decision. We have been contemplating about it for a long while before making the final call. In order to do so, we have to watch over our expenses a lot more closely (but that actually is something we should have done in the first place). For us, there are many reasons behind this decision.

Reason #1: TAX consideration

Let’s go back to 2017 December, the tax reform was signed into law, and it changed the whole game plan on tax strategy! We live in a state that has high income and property tax. Before the tax reform, our state income taxes from two full time jobs, our property tax plus our charitable donations always put us above the standard deduction. Hence, every single penny we paid towards mortgage interest would be tax deductible. Let’s assume our total tax (federal + state) rate was at 40%, so our 4% fixed rate mortgage was indeed only 2.4% with 40% discount. Taken the $200K mortgage example, the total of $143K interest was only $85K out of the pocket. Yes, it’s still a lot of money, but it is definitely much less than $143K.

After the tax reform, there is a $10,000 SALT cap deduction for married couples. Now, we may still pay $10K towards mortgage interest annually, but the SALT cap plus the mortgage interest probably will put us under the standard deduction.

In essence, our mortgage interest is no longer deduction after the tax reform. It is now a sold 4% instead of the discounted 2.4%. For us, this makes carrying our mortgage a lot less attractive.

Reason #2: Our life situation changed

We now have a son. As our lives are now evolved around him, so is our financial life too. Both Mr. G and I were debt free when we graduated from college. Once we had our first job, we started building our saving and investment. We hope little G can also start his adult life debt free. With this in mind, it is our goal to be mortgage free before little G starts college or even earlier, so we won’t be burdened by mortgage plus college tuition at the same time.

Reason #3: We decided not to want take the roof over our heads as a leverage for higher return

If we keep the mortgage for the sake of “low interest rate” so that we can make more money somewhere else, we are basically taking the roof over our heads as a leverage. Stress and risk comes with leverage. What if one of us couldn’t continue working full time due to health or family responsibility? What if our investment go south? For us, knowing that we are on the shortest path to mortgage free gives us a sense of security and peace.

Reason #4: Financial Independence

If you like to read about personal finances, you should run into the term F.I.R.E. – “Financial Independence, Retire Early”. We are not sure if we are intrigued by Retire Early. But we are definitely interested in Financial Independence. For us, financial independence means that the incomes from our job are not absolutely necessary.

Like most families, mortgage is our biggest expense. If we are mortgage free, our annual expense will shrink drastically. Other than paying down mortgage, we are also working on some other passive income sources. If things go smoothly, by the time we are mortgage free, it is possible that our jobs will become non-mandatory. Isn’t that nice?

The final verdict

Again, this is a very personal decision.

For example, my brother in law will never approve the idea of paying off mortgages early. For him, it is important to make the biggest return. He never pays safe. He invests heavily in the stock market, and making the biggest return over his money is the highest priority.

On the other hand, Mr. G and I are a lot more conservative. We don’t pay attention to the ups and downs in the stock market that much. Low-cost mutual funds are our major investments. We usually employ a long term view on our investment. For us, we appreciate our peace of mind more than the excitement of winning big.

We know this decision is right for us. As we started making extra payment to pay off our mortgage in 9 years, we are super excited and looking forward for our pay off date. We are convinced that this is the right decision for our family.